Inflammatory Bowel Disease: Market Size, Trend, by Drug Class (Aminosalicylates, Corticosteroids, TNF Inhibitors, IL Inhibitors, Anti-integrin, etc.), by Disease Type (Crohn’s Disease and Ulcerative Colitis), by Distribution Channel, End Users, Region, Major Players – Global Forecast to 2030

Wissen Research analyses that the global inflammatory bowel disease market was at USD 21 billion in 2024 and is projected to reach USD 26.5 billion by 2030, expected to grow at a CAGR of 4% during the forecast period, 2025-2030.

Key driving factors of inflammatory bowel disease market include rising prevalence of Crohn’s disease and ulcerative colitis, continuous development and adoption of advanced biologics and novel drug classes and increased healthcare expenditure and favorable reimbursement policies.

Challenges in the inflammatory bowel disease domain include high cost of biologics and branded therapies, limiting accessibility and stringent regulatory requirements and lengthy drug approval processes.

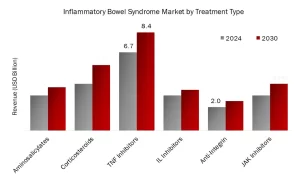

TNF inhibitors have held the largest share in the market since 2023, with North America dominating the regional market share.

Key players functioning in global inflammatory bowel disease sector are, AbbVie Inc., Takeda Pharmaceutical Company Limited, Pfizer Inc., Biogen, Novartis AG, Eli Lilly and Company, UCB S.A., Celltrion Inc., Merck & Co., Inc., Johnson & Johnson Services, Inc., Amgen Inc., Bristol Myers Squibb, among others.

Further, the US with USD 11.55 billion market in 2024, holds majority share in the global inflammatory bowel disease market and is likely to remain the leading region growing a CAGR of 4.5% within this market, during the forecast period.

Lucrative Opportunities in Inflammatory Bowel Disease Market

Global inflammatory bowel disease market is anticipated to reach USD 26.5 billion by 2030 from USD 21 billion in 2024, growing at an annualized rate of 4% during the period, 2025-2030 | Emerging economies like India, China, Brazil, South Korea, Turkey, Russia, and South Africa present significant growth opportunities for the Inflammatory Bowel Disease (IBD) market | ASIA-PACIFIC Growing awareness and rising prevalence of IBD in emerging countries is expected to provide lucrative opportunities for market players. |

Growing demand for early and effective treatment of inflammatory bowel disease (IBD) is driving the adoption of advanced biologic therapies and targeted small molecules. New drug classes, such as anti-integrins (e.g., vedolizumab) and JAK inhibitors (e.g., tofacitinib), are enabling clinicians to tailor treatment to individual patient profiles, improving remission rates and quality of life for those with Crohn’s disease and ulcerative colitis. | Emerging markets in Southeast Asia and Latin America are fueling growth in the inflammatory bowel disease (IBD) market due to increased healthcare investments, rising disease awareness, and improving infrastructure. In Southeast Asia, higher incomes and government initiatives are boosting demand for advanced IBD treatments, including biologics and biosimilars. Similarly, Latin America is seeing expanded access to innovative therapies and collaborations with global pharmaceutical companies, creating opportunities for cost-effective solutions to address the unmet needs of IBD patients |

Drivers: Continuous development and adoption of advanced biologics and novel drug classes, including anti-integrins and JAK inhibitors, improving treatment outcomes

The inflammatory bowel disease (IBD) market is driven by the ongoing development and adoption of advanced biologics and novel drug classes, such as anti-integrins (e.g., vedolizumab) and JAK inhibitors (e.g., tofacitinib). These therapies offer more targeted mechanisms of action, improved efficacy, and better safety profiles compared to traditional treatments, leading to better disease control and quality of life for patients with Crohn’s disease and ulcerative colitis.

Opportunities: Development of advanced drug delivery systems and oral formulations, enhancing patient compliance and convenience in IBD Market

The development of advanced drug delivery systems and oral formulations presents a significant opportunity in the IBD market by enhancing patient compliance and convenience. Innovations such as nanoparticle-based carriers, enteric-coated tablets, and colonic drug delivery systems enable targeted drug release directly at inflamed intestinal sites, minimizing systemic side effects and reducing dosing frequency. These approaches not only improve therapeutic efficacy but also address common adherence challenges, as studies show IBD patients overwhelmingly prefer oral tablets for their ease and convenience compared to injections or infusions. Overall, these advancements are making IBD treatment more patient-centric and effective.

Challenges: Significant side effects and safety concerns associated with current IBD treatments, impacting patient adherence and quality of life in IBD Market

Significant side effects and safety concerns associated with current IBD treatments-such as corticosteroids, immunomodulators, and biologics-pose major challenges for patient adherence and quality of life. Common adverse effects include increased risk of infections, osteoporosis, diabetes, hypertension, and even certain cancers, particularly with long-term steroid or immunosuppressant use. For example, corticosteroids can cause serious complications like osteoporosis and high blood pressure, while immunomodulators and biologics may lead to infections and rare but serious malignancies. These risks often result in patients discontinuing or hesitating to continue therapy, directly impacting disease management and overall well-being.

The global inflammatory bowel disease (IBD) market, encompassing treatments for Crohn’s disease and ulcerative colitis, is experiencing robust growth due to rising disease prevalence, improved diagnostics, and the ongoing development of advanced biologics and novel therapies. Valued at USD 21 billion in 2024, the market is projected to reach nearly USD 26.5 billion by 2030, expanding at a CAGR of around 4%. Key drivers include greater disease awareness, increased healthcare spending, and a strong pipeline of innovative drugs, with major industry players investing in research and development to address unmet needs and improve patient outcomes

TNF Inhibitors Dominated the Inflammatory bowel disease Market by Drug Class in 2024

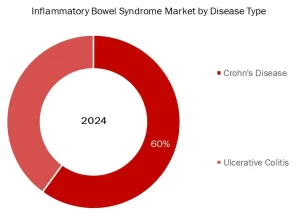

Crohn’s Disease held the largest market share in 2024, accounting for a significant 60% market share in Inflammatory Bowel Disease market

North America held the largest market share in Inflammatory Bowel Disease Market in the forecast period

North America held the largest market share in the inflammatory bowel disease (IBD) market during the forecast period, accounting for approximately 41.7% in 20253. This dominance is attributed to a high prevalence of Crohn’s disease and ulcerative colitis, advanced healthcare infrastructure, greater awareness, and significant adoption of biologic therapies. The region also benefits from a strong pharmaceutical industry and supportive healthcare policies, particularly in the United States, which drives demand for innovative IBD treatments and ongoing clinical research.

Asia Pacific is the fastest-growing region in the global inflammatory bowel disease (IBD) market, driven by rising incidence rates of Crohn’s disease and ulcerative colitis, rapid urbanization, changing dietary habits, and increasing disease awareness. The region is projected to grow at a CAGR of 6.5%-the highest globally-supported by expanding healthcare infrastructure, greater healthcare spending, and improved diagnostic capabilities, especially in countries like China, India, and Japan.

Major players operating in Inflammatory Bowel Disease market are:

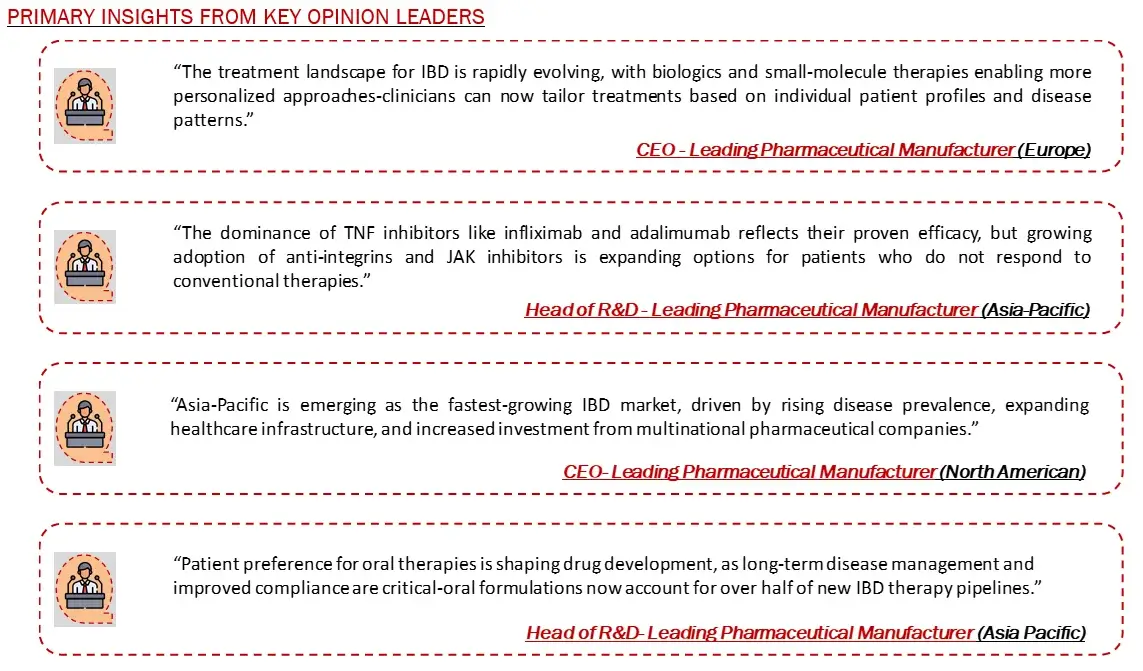

PRIMARY INSIGHTS FROM KEY OPINION LEADERS

Note: Above mention is non-exhaustive samples of the primary insights.

Particulars | Details |

Report | Inflammatory Bowel Disease Market |

Forecast Period | 2025-2030 |

Base Year | 2024 |

Format | |

Market Size (2024) | USD 21 Billion |

CAGR (2025-2030) | 4% |

Number of Pages | 171 |

Number of Tables | 160 |

Number of Figures | 34 |

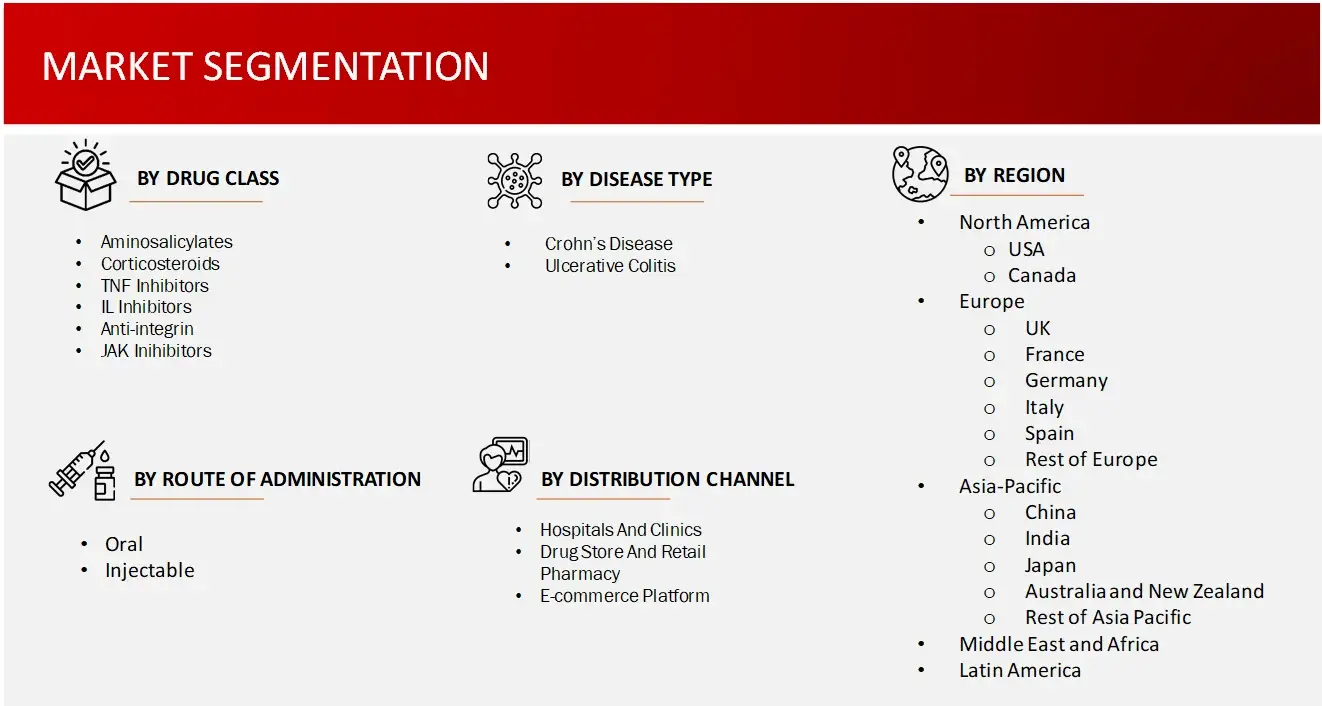

Key Segments | Inflammatory Bowel Disease Market Drug Class Outlook (Aminosalicylates, Corticosteroids, TNF Inhibitors, IL Inhibitors, Anti-Integrin and JAK Inhibitors)

Inflammatory Bowel Disease Market Disease Type Outlook (Crohn’s Disease and Ulcerative Colitis) Inflammatory Bowel Disease Market Route of Administration Outlook (Oral and Injectable) Inflammatory Bowel Disease Market Distribution Channel Outlook (Hospitals and Clinics, Drug Store and Retail Pharmacy and E-Commerce Platform) |

Regions Covered |

|

Key Players Covered (Majority Share Holders) | Abbvie Inc. (US), Takeda Pharmaceutical Company Limited. (Japan), Pfizer Inc. (US), Biogen (US), Novartis AG (Switzerland), Eli Lilly and Company (US), UCB S.A. (Belgium), Celltrion Inc. (US), Merck & Co., Inc. (US), Johnson & Johnson Services, Inc. (US), Amgen Inc. (US), Bristol Myers Squibb (US) |

Market Definition

The inflammatory bowel disease (IBD) market encompasses the diagnosis, management, and treatment of chronic gastrointestinal disorders, primarily Crohn’s disease and ulcerative colitis, characterized by persistent inflammation of the digestive tract. The market includes a range of therapies such as biologics, small molecules, corticosteroids, and immunomodulators, aimed at inducing and maintaining remission, reducing inflammation, and improving patient quality of life.

FIGURE: INFLAMMATORY BOWEL DISEASE MARKET SEGMENTS

The objective of the study is to analyze the key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies. To track company developments such as product launches and approvals, expansions, and collaborations of the leading players, the competitive landscape of the lupus nephritis market to analyze market players on various parameters within the broad categories of business and product strategy. Top-down and bottom-up approaches will be used to estimate the market size. To estimate the market size of segments and sub segments the market breakdown and data triangulation will be used.

FIGURE: RESEARCH DESIGN

Sources: Wissen Research Analysis

Collecting Secondary Data

The secondary research data collection process involves the usage of secondary sources, directories, databases, annual reports, investor presentations, and SEC filings of companies. Secondary research will be used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the lupus nephritis market. A database of the key industry leaders will also be prepared using secondary research.

The primary research data will be conducted after acquiring knowledge about the lupus nephritis market scenario through secondary research. A significant number of primary interviews will be conducted with stakeholders from both the demand side and supply side (including various industry experts, such as Directors, Chief X Officers (CXOs), Vice Presidents (VPs) from business development, marketing and product development teams, product manufacturers) across major countries of North America, Europe, Asia Pacific, and Rest of the World. Primary data for this report was collected through questionnaires, emails, and telephonic interviews.

All major manufacturers offering various lupus nephritis will be identified at the global/regional level. Revenue mapping will be done for the major players, which will further be extrapolated to arrive at the global market value of each type of segment. The market value of lupus nephritis market will also split into various segments and sub segments at the region level based on:

After arriving at the overall market size-using the market size estimation processes-the market will be split into several segments and sub segment. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, the data triangulation, and market breakdown procedures will be employed, wherever applicable. The data will be triangulated by studying various factors and trends from both the demand and supply sides in the lupus nephritis market industry.

1.1 KEY OBJECTIVES

1.2 DEFINITIONS

1.2.1 IN SCOPE

1.2.2 OUT OF SCOPE

1.3 SCOPE OF THE REPORT

1.4 SCOPE RELATED LIMITATIONS

1.5 KEY STAKEHOLDERS

2. RESEARCH METHODOLOGY

2.1 RESEARCH APPROACH

2.2 RESEARCH METHODOLOGY / DESIGN

2.3 MARKET SIZE ESTIMATION APPROACHES

2.3.1 SECONDARY RESEARCH

2.3.2 PRIMARY RESEARCH

2.4 KEY INSIGHTS FROM INDUSTRY EXPERTS

2.5 DATA VALIDATION & TRIANGULATION

2.6 ASSUMPTIONS OF THE STUDY

3. EXECUTIVE SUMMARY & PREMIUM CONTENT

3.1 GLOBAL MARKET OUTLOOK

3.2 KEY MARKET FINDINGS

4. MARKET OVERVIEW

4.1 INFLAMMATORY BOWEL DISEASE: OVERVIEW

4.1.1 INTRODUCTION

4.1.2 SIGNS AND SYMPTOMS

4.1.3 CAUSES OF INFLAMMATORY BOWEL DISEASE

4.1.4 CLASSIFICATION OF INFLAMMATORY BOWEL DISEASE

4.1.5 PATHOPHYSIOLOGY

4.1.6 DIAGNOSIS OF INFLAMMATORY BOWEL DISEASE

4.1.6.1 DIAGNOSTIC TESTS

4.1.6.2 DIFFERENTIAL DIAGNOSIS OF INFLAMMATORY BOWEL DISEASE

4.1.6.3 DIAGNOSTIC GUIDELINES

4.1.7 PROGNOSIS

4.1.8 TREATMENT OF INFLAMMATORY BOWEL DISEASE

4.1.8.1 FUTURE TREATMENT MODALITIES

4.1.8.2 GENERAL RECOMMENDATIONS FOR INFLAMMATORY BOWEL DISEASE TREATMENT

4.1.8.3 TREATMENT GUIDELINES FOR INFLAMMATORY BOWEL DISEASE

4.2 MARKET DYNAMICS

4.2.1 MARKET DRIVERS

4.2.2 MARKET OPPORTUNITIES

4.2.3 RESTRAINTS/CHALLENGES

4.3 END USER PERCEPTION

4.4 NEED GAP ANALYSIS

4.5 KEY CONFERENCES

4.6 EPIDEMIOLOGY

4.7 PATIENT JOURNEY MAPPING: INFLAMMATORY BOWEL DISEASE

4.8 SUPPLY CHAIN / VALUE CHAIN ANALYSIS

4.9 INDUSTRY TRENDS

4.10 PORTER’S FIVE FORCES ANALYSIS

4.11 REGULATORY LANDSCAPE

4.11.1 NORTH AMERICA

4.11.2 EUROPE

4.11.3 ASIA PACIFIC

4.12 REIMBURSEMENT SCENARIO

5. PATENT ANALYSIS

5.1 TOP ASSIGNEES

5.2 GEOGRAPHY FOCUS OF TOP ASSIGNEES

5.3 LEGAL STATUS

5.4 TECHNOLOGY EVOLUTION

5.5 KEY PATENTS

5.6 PATENT TRENDS AND INNOVATIONS

6. CLINICAL TRIAL ANALYSIS

6.1 ANALYSIS BY TRIAL REGISTRATION YEAR

6.2 ANALYSIS BY PHASE OF DEVELOPMENT

6.3 ANALYSIS BY TRIAL STATUS

6.4 ANALYSIS BY NUMBER OF PATIENTS ENROLLED

6.5 ANALYSIS BY STUDY DESIGN

6.6 ANALYSIS BY TYPE OF THERAPY / DRUG

6.7 ANALYSIS BY GEOGRAPHY

6.8 ANALYSIS BY KEY SPONSORS / COLLABORATORS

7. GLOBAL INFLAMMATORY BOWEL DISEASE TREATMENT MARKET BY, DISEASE TYPE (2024-2030, USD MILLION)

7.1 CROHN’S DISEASE

7.2 ULCERATIVE COLITIS

8. GLOBAL INFLAMMATORY BOWEL DISEASE TREATMENT MARKET BY, DRUG CLASS (2024-2030, USD MILLION)

8.1 AMINOSALICYLATES

8.2 CORTICOSTEROIDS

8.3 TNF INHIBITORS

8.4 IL INHIBITORS

8.5 ANTI-INTEGRIN

8.6 JAK INIHIBITORS

9. GLOBAL INFLAMMATORY BOWEL DISEASE TREATMENT MARKET BY, ROUTE OF ADMINISTRATION (2023-2030, USD MILLION)

9.1 ORAL MARKET

9.2 INJECTABLE MARKET

10. GLOBAL INFLAMMATORY BOWEL DISEASE TREATMENT MARKET BY, DISTRIBUTION CHANNEL (2023-2030, USD MILLION)

10.1 HOSPITALS AND CLINICS

10.2 DRUG STORE AND RETAIL PHARMACY

10.3 E-COMMERCE PLATFORM

11. GLOBAL INFLAMMATORY BOWEL DISEASE MARKET BY, REGION (2023-2030, USD MILLION)

11.1 NORTH AMERICA

11.1.1 US

11.1.2 CANADA

11.2 EUROPE

11.2.1 GERMANY

11.2.2 FRANCE

11.2.3 SPAIN

11.2.4 ITALY

11.2.5 UK

11.2.6 REST OF THE EUROPE

11.3 ASIA-PACIFIC

11.3.1 CHINA

11.3.2 JAPAN

11.3.3 INDIA

11.3.4 AUSTRALIA AND NEW ZEALAND

11.3.5 SOUTH KOREA

11.3.6 REST OF THE ASIA-PACIFIC

11.4 MIDDLE EAST AND AFRICA

11.5 LATIN AMERICA

12. COMPETITIVE ANALYSIS

12.1 PRODUCT PIPELINE: INFLAMMATORY BOWEL DISEASE TREATMENT

12.2 KEY PLAYERS FOOTPRINT ANALYSIS

12.3 MARKET SHARE ANALYSIS (2023/2024)

12.4 REGIONAL SNAPSHOT OF KEY PLAYERS

12.5 R&D EXPENDITURE OF KEY PLAYERS

13. COMPANY PROFILES

13.1 ABBVIE INC.

13.1.1 BUSINESS OVERVIEW

13.1.2 PRODUCT PORTFOLIO

13.1.3 FINANCIAL SNAPSHOT

13.1.4 RECENT DEVELOPMENTS

13.1.4.1 MERGER/ACQUISITIONS

13.1.4.2 PRODUCT APPROVAL/LAUNCHES

13.1.4.3 PARTNERSHIP/COLLABORATIONS/AGREEMENTS

13.1.4.4. EXPANSIONS

13.2 TAKEDA PHARMACEUTICAL COMPANY LIMITED.

13.3 PFIZER INC.

13.4 BIOGEN

13.5 NOVARTIS AG

13.6 ELI LILLY AND COMPANY

13.7 UCB S.A.

13.8 CELLTRION INC.

13.9 MERCK & CO., INC.

13.10 JOHNSON & JOHNSON SERVICES, INC.

13.11 UCB S.A.

13.12 AMGEN INC.

13.13 BRISTOL MYERS SQUIBB

14. APPENDIX

14.1 INDUSTRY SPEAK

14.2 QUESTIONNAIRE/DISCUSSION GUIDE

14.3 AVAILABLE CUSTOM WORK

14.4 ADJACENT STUDIES

14.5 AUTHORS

15. REFERENCES

Key Notes:

Note 1 – Contents in the ToC / market segments are tentative and might change as the research proceeds.

Note 2 – List of companies is not exhaustive and might change during the course of study.

Note 3 – Details on key financials might not be captured in case of unlisted companies.

Note 4 – SWOT analysis will be provided for top 3-5 companies.

The global market for Inflammatory Bowel Disease was valued at approximately USD 21 billion in 2024, and is projected to increase to USD 21.8 billion in 2025.

The global Inflammatory Bowel Disease market is anticipated to grow at an annual growth rate of 4% from 2025 to 2030 to reach USD 26.5 billion, by 2030.

The major distribution channels in the Inflammatory Bowel Disease market include Hospitals and Clinics, Drug Store and Retail Pharmacy and E-Commerce Platform, with hospitals and clinics still being a significant segment due advanced infrastructure, higher patient intake, and ability to dispense specifically designed doses all under the same roof, holding nearly 40% of the market share.

Leading players within the inflammatory bowel disease market are Abbvie Inc. (US), Takeda Pharmaceutical Company Limited. (Japan), Pfizer Inc. (US), Biogen (US) and Novartis AG (Switzerland)

The inflammatory bowel disease market is “Consolidated.” The top 3-5 companies-such as AbbVie Inc., Takeda Pharmaceutical Company Limited, Johnson & Johnson Services Inc., Bristol-Myers Squibb, and Pfizer-collectively account for more than 50% but less than 70% of the total market share. These major players dominate with blockbuster biologics and innovative therapies, but there remains a competitive presence from other large and mid-sized pharmaceutical firms, preventing the market from being classified as “Highly Consolidated”.